What’s the buzz around the Research and Development Tax Incentive (R&DTI)? Is it just another grant, or is there more to it?

For over four decades, the R&DTI has been a game-changer for Australian businesses, offering tax credits to cut down on research and development costs. It’s not just for the big players; startups and established companies in tech, manufacturing, pharma, agriculture and other industries can all benefit. By providing tax offsets for eligible R&D activities, the incentive fuels innovation and helps businesses grow and compete globally.

Let’s break it down with some practical insights and examples from experts to help you get the most out of the R&DTI.

In the next 8 minutes or so, we’ll comprehensively cover:

R&D Tax Incentive

1 – What is the R&D Tax Incentive?

The Research and Development Tax Incentive (R&DTI) is a government program that provides a tax offset to Australian businesses that are engaged or planning to invest in eligible R&D activities. The primary aim of the program is to encourage innovation by reducing the financial risks associated with R&D projects, thereby stimulating advancements across various industries.

By participating, businesses like yours can significantly recover some of their investments, offsetting a portion of the costs associated with their R&D endeavours. This incentive stimulates innovation across various industries by reducing the financial risks associated with R&D projects while allowing business owners to make ambitious projects more feasible and less financially daunting.

2 – Why Should You Apply for the R&DTI and Is It Worth It?

Wondering why you should apply for the R&DTI and what its benefits are? The Research & Development Tax Incentive can become much more than just a financial incentive for your business in Australia. It’s an opportunity to propel your company forward and ensure long-term success.

Here are just 3 reasons why you should seriously consider it:

- Financial Relief: You can offset up to 43.5% of your R&D costs, providing a substantial reduction in your overall expenses.

- Growth Potential: The financial benefits can be reinvested into your business, fuelling further innovation and expansion.

- Collaboration: Partnering with registered Research Service Providers can enhance your R&D efforts and outcomes, driving your projects to new heights.

3 – What R&D Costs Can Be Claimed?

The R&D tax benefits cover a variety of costs associated with research and development activities, making it easier for businesses to manage their expenses.

Some examples of eligible costs could include:

- Employee Wages: Salaries and associated costs (such as superannuation) for employees directly involved in R&D activities.

- Materials and Equipment: Costs of materials and equipment used specifically for R&D projects.

- Testing Expenses: Expenditures related to testing and experiments conducted as part of your R&D.

- Overheads: Relevant overhead costs that can be attributed to R&D activities such as subscriptions, phone and internet bills and even rent.

A careful examination of each eligible cost ensures that businesses make the most of this opportunity, enhancing the financial benefits derived from R&D activities.

4 – How Much Can You Claim?

The golden question: how much can you receive under the R&DTI?

The answer is – up to 43.5% of your Research and Development costs from the previous financial year. The exact amount you can claim through varies based on your business’s turnover:

- Businesses with less than $20 million turnover: The refundable R&D tax offset is your corporate tax rate plus an 18.5% premium.

- Businesses with more than $20 million turnover: The non-refundable R&D tax offset is your corporate tax rate plus an incremental premium.

Let’s look at two examples:

- A business with a $5 million turnover spending $250,000 on R&D in one financial year with a corporate tax rate of 30%, could be eligible for a $121,250 refund.

- A business with a $25 million turnover spending $500,000 on R&D in the last financial year with a 30% corporate tax rate, could be eligible for $192,500 to $232,500, depending on their R&D intensity which informs the incremental premium.

To get a rough indication of the amount your business can receive, utilise this free R&D Tax Incentive calculator.

Not sure if you’re eligible for the R&D Tax Incentive?

Our free Blueprint breaks it down with an eligibility checklist, examples, and expert tips from the FundFindrs team.

5 – Is There a Minimum Spending Requirement?

Currently, businesses need to have a minimum R&D spend of $20,000 to qualify for this valuable incentive. This spending threshold is a key factor to consider as you explore the potential benefits and opportunities that the R&D Tax Incentive can bring to your business. Collaboration with registered Research Service Providers (RSPs) is often beneficial, as you don’t have to reach the minimum spend threshold to claim the R&DTI if you use an RSP.

6 – Are You Eligible?

If you’ve made it this far, you might be considering: “Is my business eligible for this Incentive?” Let’s find out.

Eligibility for the R&D Tax Incentive is designed to be accessible to a wide range of businesses. To qualify, your business must be:

- Incorporated in Australia: Alternatively, if your business is under foreign law but conducts eligible R&D activities in Australia, you may still qualify.

- Meeting the Spending Threshold: Your business must spend over $20,000 on eligible R&D activities in a financial year. This ensures that the incentive supports substantial and impactful research and development efforts.

- Conducting R&D Activities: Your company needs to be conducting or planning to conduct at least one eligible R&D activity. Those activities can attempt to generate new/improved products, services, and processes or can be conducted to support them.

There are other main criteria and requirements to determine your eligibility and guide you through the identification of a Core or Supporting R&D Activity. To find out if your business could be eligible for the R&DTI get in contact with our team of experts to book a FREE meeting.

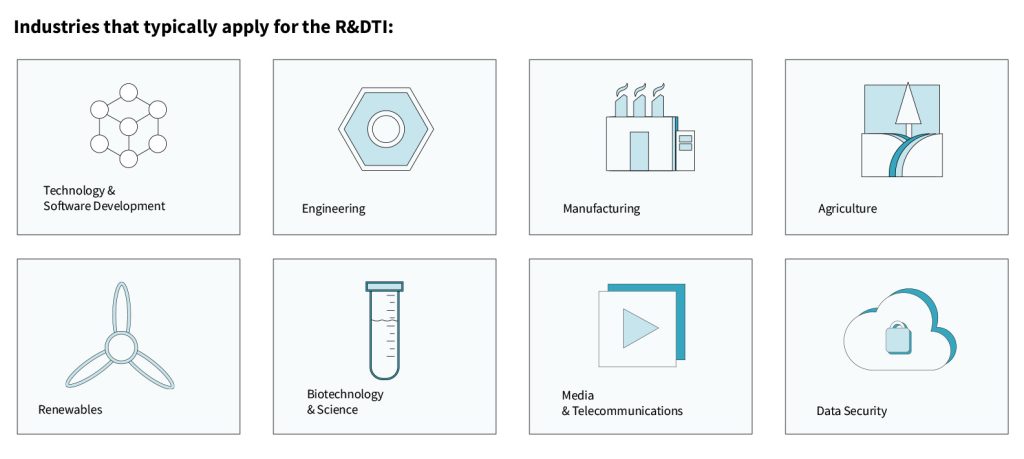

7 – What are the most common industries that typically apply for the R&DTI?

Companies from many industries can benefit from the R&D Tax Incentive to drive innovation and growth to their business. It’s common to see technology and software development companies leverage the incentive to fund advancements in digital solutions, enhancing efficiency and user experience.

Other frequent examples are engineering and manufacturing companies which also heavily invest in innovation through the incentive, fostering the development of new products and processes that improve productivity and competitiveness. Additionally, companies from agriculture, mining, biotechnology, renewables, and other sectors typically submit their applications to the R&D Tax Incentive to help them innovate and create new services/products.

While these industries have traditionally been prominent users of the program, the scope of eligible activities is broad, inviting exploration from other sectors keen on advancing through research and development. The R&D Tax Incentive boasts a substantial fund exceeding $1 billion, offering an expansive resource for all types of businesses.

8 – How simple is the R&DTI Application Process?

Applying for the R&D Tax Incentive involves several key steps to ensure that your application is thorough and accurate and can look like the following:

- Assess Eligibility: Review the program’s criteria to confirm that your business qualifies, and your R&D activities are eligible.

- Prepare Documentation: Compile detailed records of the nature and scope of your R&D activities, including financial statements and project descriptions.

- Submit Application: Submit your completed application to the Australian Taxation Office (ATO) and the Department of Industry, Innovation, and Science. You must submit your application within 10 months after the end of the financial year.

Maybe you are thinking: “There are too many steps involved in this process and I don’t have time to do so, so should I bother applying?”

Although there are a handful of steps involved in applying for the R&D Tax Incentive, keep in mind all the potential benefits quite outweigh the time spent doing so. Additionally, we can relieve the pressure from your shoulders. One way to boost your chances of success is by letting our team of experts handle the entire process for you. Book a free consultation to get the information and support you need to confidently complete your R&DTI claim.

9 – What’s the Timeline from Applying to Receiving the R&DTI Funds?

Now that we’ve covered the details of the Research and Development Tax Incentive, the next question naturally revolves around understanding the timeline and all its steps—from the day you apply to the moment the refund lands in your account. This understanding is crucial to effectively plan your finances and, possibly, bring forward your plans to growth and (re)invest.

Applications typically run from 1 July to 30 April of the following financial year. For instance, if you’re claiming for the financial year 1 July 2023 – 30 June 2024, you can apply from 1 July 2024 to 30 April 2025. Once approved, funds usually reach your account within a few weeks to a couple of months, providing timely financial support to your business.

You can streamline this process and strategically optimise your outcome by count with our support. The FundFindrs team is ready to assist you through this process, allowing you to reinvest funds into your business as quickly as possible.

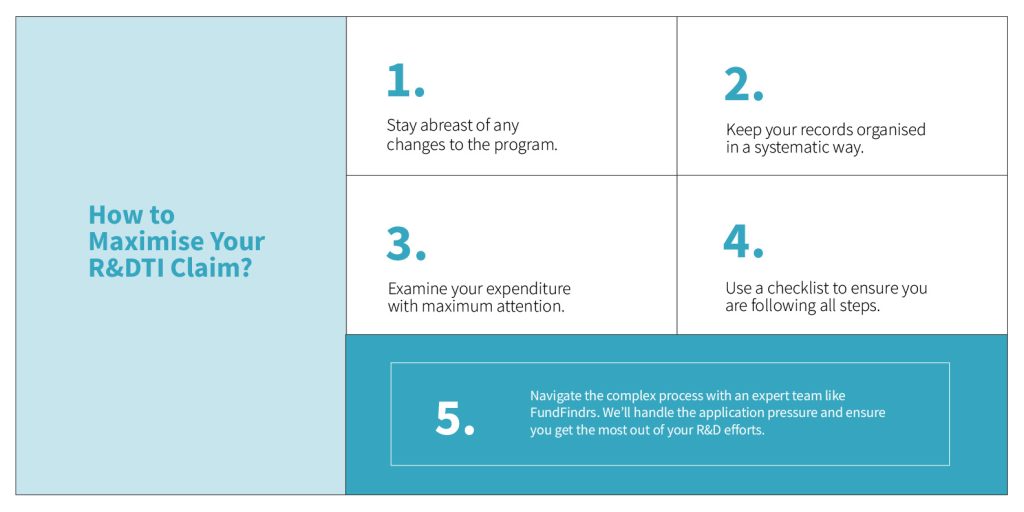

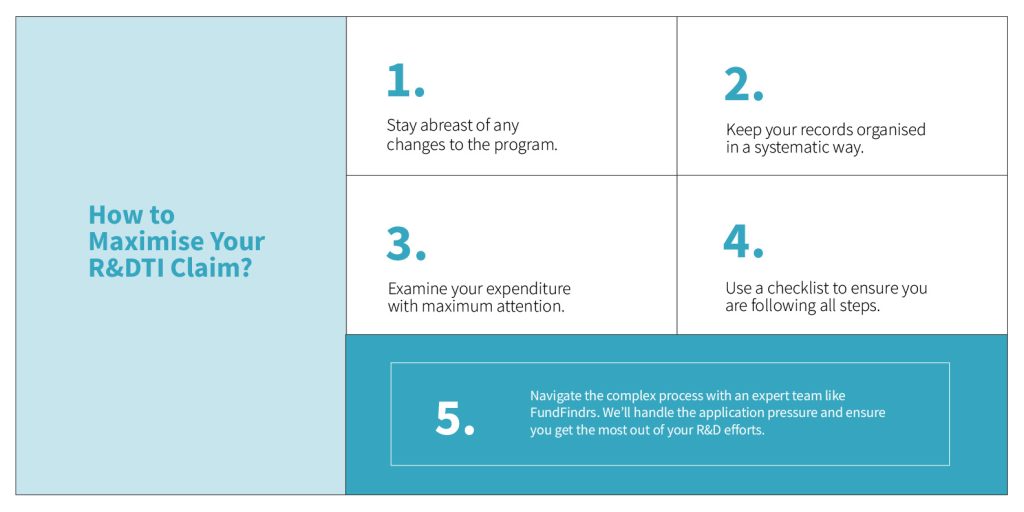

10 – How to Maximise Your R&DTI Claim?

Are you ready to take most advantage of the Research & Development Tax Incentive (RDTI)? there a several ways to maximise your claim and make sure your process is thorough and solid. Here are some tips:

- Stay abreast of any changes to the program. Any recent changes that may impact your eligibility or the benefits you can receive will be carefully considered in your unique strategy. An easy way to stay on top is signing up for our Newsletter and following us on LinkedIn, Facebook and Instagram. We stay informed, so you don’t have to.

- Keep your records organised in a systematic way. Having well-organised documentation not only strengthens your claim but simplifies the RDTI process.

- Examine your expenditure with maximum attention to allocate all possible expenses to streamline your claim.

- Use a checklist to ensure you are claiming the R&DTI correctly according to the legislation minimising compliance risks. The catch to better securing this grant? Nailing your application.

- Navigate the complex process with an expert team like FundFindrs. We’ll handle the application pressure and ensure you get the most out of your R&D efforts.

Book your FREE 30 minute starter chat with us

Before You Go

Don’t let your innovation go unrewarded. Unlock your next phase of growth with the Australian R&D Tax Incentives by reaping its countless benefits. Whilst the application process is detailed, the returns are well worth the investment.

So do your business (and yourself) a favour and get applying! And as always, the FundFindrs team is here to assist you through the entire process as well as any other queries or questions.

Simply send us an email or give us a call at (02) 9072 1720 at anytime and we’ll get back to you ASAP.