Securing initial capital remains a significant hurdle for female-led organisations in Australia.

Recent reporting from the State of Australia’s Startup Funding reinforced this disparity, showing that from a $4 billion funding pool, only 2% was allocated to businesses founded entirely by women, 15% went to ventures with at least one female founder, while a staggering 70% was directed toward male-founded startups.

This is why initiatives like the Female Founders Co Investment fund provided by the Queensland Government have been introduced to reduce the support gap that female innovators often face.

In this article, we break down the Co Investment structure and what you need to know before applying. We also cover some features that can help increase the strength of your application.

-

-

- What is the Female Founders Co Investment Fund?

- Program funding available

- How can I secure the Female Founders Fund

- Co-investment breakdown

- Timings and deadlines

- Uses of funding

- Expenditure not covered by funding

- What is the closing date for applications?

- Application status

1. What is the Female Founders Co Investment Fund?

The Female Founders Co-Investment Fund was launched to support female-led, innovation-driven businesses in Queensland that are raising early-stage capital. The goal is to increase the volume and quality of private investment flowing to women-founded businesses with high-growth potential.

The program offers matched grant funding to support qualifying capital raises.

2. Program funding available

The Female Founders Co-Investment Fund QLD is open to businesses looking at securing early investment. This grant has a threshold of $50,000 minimum to a maximum grant of $200,000 (1:3 matched with private investment).

3. How can I secure the Female Founders Fund

- Must be headquartered in Queensland, with an active ABN and GST registration

- Be a female-founded and female-led business for at least six months prior to applying:

- Majority female-owned: at least 51% of shares held by a woman or women

- Female-led: at least one woman holds a primary executive role (e.g. CEO, CFO, CTO, CSO)

- If shares are held via a trust, the business must still demonstrate compliance

- Be an innovation-driven enterprise (IDE) developing or commercialising innovative products or services

- Have no more than 50 full-time equivalent employees

- Not be a subsidiary of a larger group

- Not have previously raised more than $500,000 in capital.

Book a FREE consultation to find out if your business matches the application criteria.

4. Co-investment breakdown

This fund adopts an alternative approach in government support by utilising a co-investment method. Rather than providing individual grants, the program is designed to work together with private investors.

For every $3 raised from eligible external investors, the fund contributes $1 as a grant, up to a maximum of $200,000 (excluding GST), paid over a 12-month period.

What does this mean?

Here’s an example of how the 1:3 ratio works:

-

- A startup led by a female founder secures $180,000 from eligible investors.

-

- The government fund will contribute $60,000 as a grant.

That means the total funds available to the startup become:

$180,000 (investors) + $60,000 (grant) = $240,000

To qualify for a minimum grant of $50,000, the organisation must secure at least $150,000 in external investment.

If this grant isn’t the one for you, check out our Top 5 Queensland Government Business Grants.

5. Timings and deadlines

An important aspect of the Female Founders Co-Investment Fund is timing. Businesses that are provisionally approved for funding do not receive the grant immediately.

Instead, they are given 180 calendar days (six months) to secure the required private investment from eligible investors.

Application timeline:

-

- Apply: Your application is assessed.

-

- If provisionally approved: That means the fund likes your application in principle, but you don’t get the money right away.

-

- Clock starts: From the date of your provisional approval, you have 180 calendar days to secure your external private investment.

-

- If you succeed: Once you show proof of investment, the grant is confirmed and paid out.

-

- Unsuccessful: If you can’t secure the private investment in that timeframe, the grant funding offer lapses.

6. Uses of funding

In the application, the use of funds must be specified. The grant must be used for projects to grow the business, such as:

-

- marketing and advertising

-

- salary expenditure – subject to terms

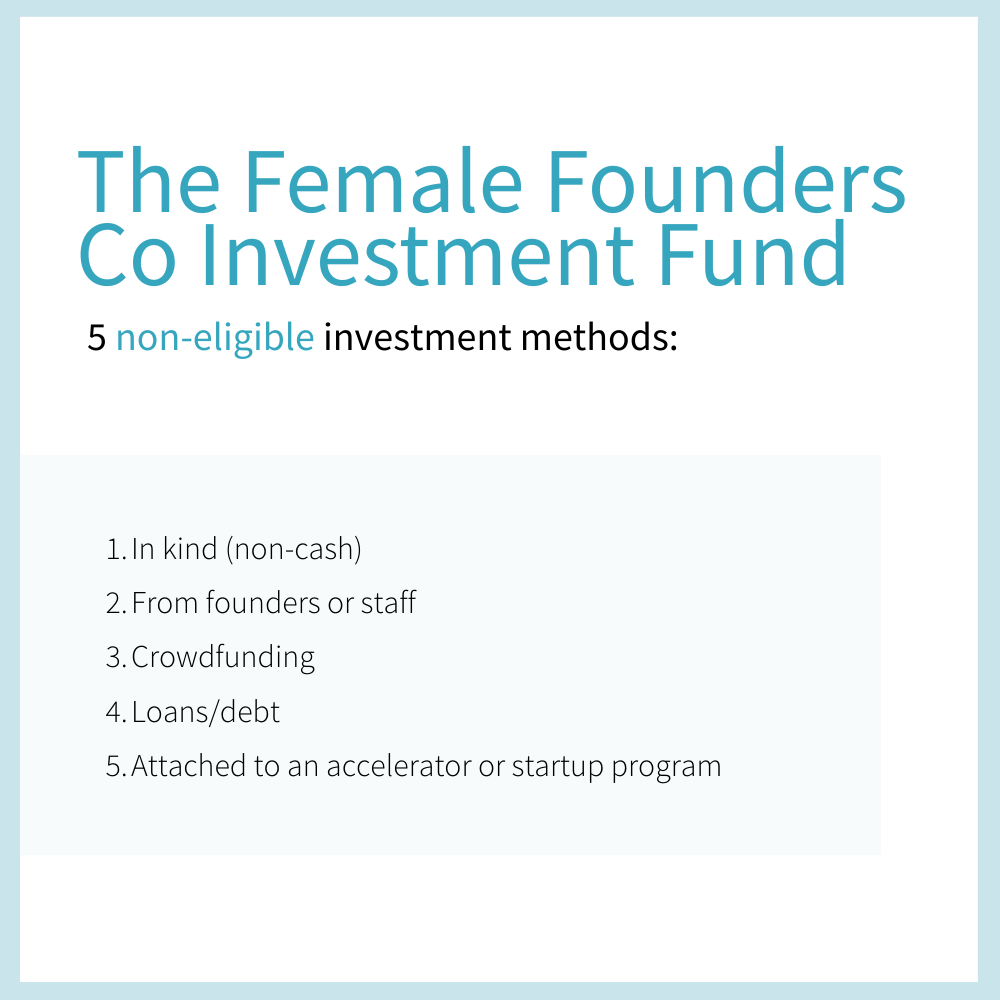

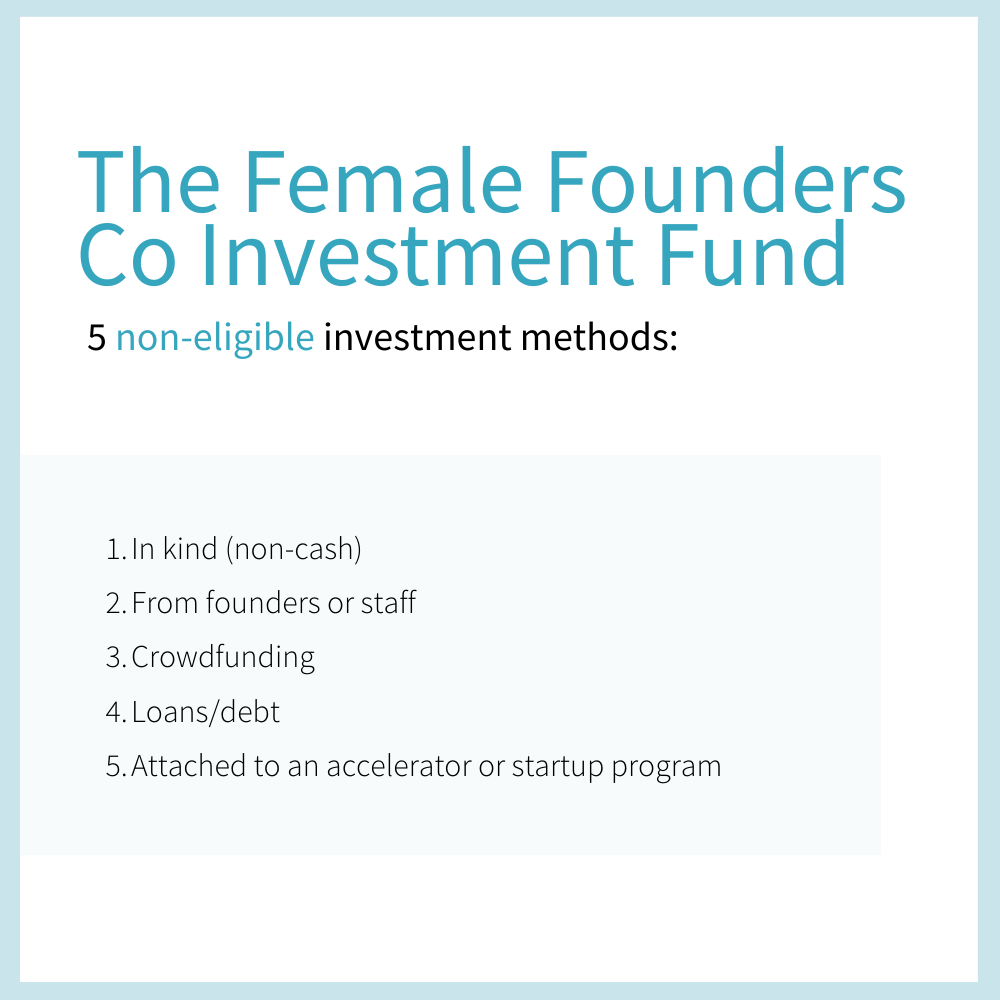

7. Expenditure not covered by funding

-

- construction of physical or IT infrastructure

-

- general business operating costs

8. What is the closing date for applications?

The Program will remain open until all funds have been allocated.

Applicants who meet the eligibility criteria will be assessed competitively and notified of the outcome by email within approximately 6-10 weeks.

Not sure where to start, find out how a grant expert can help you: What Does a Grant Consultant Do? | Comprehensive Guide by FundFindrs

9. Application status

Great news, submissions are now OPEN. Make sure your application is ready; remember you only have 6 months to secure funding once approved.

If your business is currently raising or preparing to, this program can significantly boost your capital support. The FundFindrs team of experts can help you prepare the funding strategy, validate eligibility, and align your investment narrative to meet requirements.

Maybe the Female Founders Co Investment Fund is not suitable to you, check out alternative supports available to Women In Business.

While self-assessment is possible, it’s easy to miss opportunities or make simple mistakes that will result in your application been rejected. Working with FundFindrs can help increase your chances of approval and ensure you optimise your time attracting external investment.

Book a FREE consultation with our team today.