The R&D Tax Incentive Unpacked: All your burning questions answered.

What’s the buzz around the Research and Development Tax Incentive (R&DTI)? Is it just another grant, or is there more to it? For over four decades, the R&DTI has been…

The June 30th end of the financial year (EOFY) is almost upon us, meaning now is the time for businesses to act. However, you shouldn’t see EOFY as purely a compliance deadline. Instead view it as your prime opportunity to be proactive and organise your finances, implement strategies to reduce your tax burden, and strategically plan for future growth.

And why not take the opportunity to prepare your R&D Tax Incentive (R&DTI) documentation at the same time?

In this guide we focus on what matters most for your business this EOFY: key dates, understanding tax return types, and deploying effective strategies to maximise deductions and ensure a successful tax time. And for maximum efficiency, get your documentation ready for upcoming R&DTI claim.

Knowing your key lodgement dates will help you stay organised during tax time. There are various deadlines to pay attention to, depending on your circumstances. According to the Australian Taxation Office (ATO), the deadlines are:

For individuals — 31st October

For businesses — 28th February

And there are the crucial deadlines for Business Activity Statements (BAS) and Taxable Payments Annual Report (TPAR) around the end of the financial year.

Your BAS reporting frequency (monthly, quarterly, or annually) determines your specific due dates.

If your business pays contractors for services in industries like building and construction, cleaning, courier services, road freight, IT services, or security, investigation, or surveillance services, you must lodge a TPAR.

The EOFY requires thorough financial housekeeping, compliance adherence, and planning. Successfully navigating this period ensures accuracy in your reporting, helps you meet your obligations, and positions your business for future success.

To guide you through the essential activities — from year-round record-keeping and embracing technology to specific tasks like finalising accounts, managing tax obligations, and reviewing your overall business strategy — here is our comprehensive checklist to help you through a smooth and productive EOFY process.

The first step to getting organised for tax time success is gather all your important paperwork, like receipts, invoices, bank statements, and any other relevant documents throughout the year. Having everything in order saves time and by doing this you can easily categorise them at the end of each financial year.

Managing your documents is not always easy, so take advantage of accounting software or record-keeping apps to simplify the process. These tools can help you with expenses, generate reports and connect you directly to your tax accountant. This can simplify record-keeping throughout the year and result in a smoother EOFY process for you.

Tax matters can be complex or overwhelming, so it could be worth consulting a tax accountant and seeking advice. A qualified tax professional can provide expert guidance and determine the best approach for filing combined returns. They will ensure compliance with tax laws, help you navigate deadlines, and maximise deductions across your business and personal finances.

Paying for expenses that can qualify for a tax deduction before June 30 will boost your tax refund. These costs might come from work-related expenses or donations to charities. Check out the ATO guidelines to see what work-related costs you can claim.

You can deduct bad debts from your taxes if you don’t think you’ll be able to pay them back. You need to have proof of your claim and have made a sincere effort to collect the debt to be eligible for a bad debt deduction. Reducing your taxable income can be achieved by writing off bad debts before the end of the financial year. This can be helpful when filing your tax return lodgement. Speak to your accountant to see if this is the right option for you.

Bank accounts, debtors, asset registry, and other assets, like payroll-related income in advance, leases, and other liabilities, can be addressed in reconciliations. Make sure your bank statements and bookkeeping records match. Plan to avoid delays and meet end of financial year deadlines.

Examine your asset register and make any necessary updates, including asset sales or purchases, during the financial year. Analyse and precisely record the depreciation costs for every asset.

Examine your business expenses to make sure they are justified and accompanied by the necessary records. Determine whatever tax write-offs or deductions might be available for the current fiscal year.

Prepare and submit your BAS, outlining all transactions related to GST for the fiscal year. Make certain that every statistic is true and backed up by the necessary records.

Tax time can be a good opportunity to review your superannuation requirements for the new financial year. As a business, it is your legal obligation to pay superannuation guarantee (SG) payments to eligible employees. Ensure timely payments and maintain accurate records to avoid penalties from the ATO. For every eligible employee, you are required to pay at least 11.5% of their ordinary time earnings (OTE) as the SG rate. Consider consulting with a financial advisor to optimise your superannuation strategy, ensuring compliance and maximising benefits for both your business and your employees.

Keeping correct and accurate payroll records comes next on the EOFY checklist. Employers are required to utilise Single Touch Payroll (STP) to automatically transmit payroll tax information to the ATO for reporting purposes.

The Taxable Payments Annual Report (TPAR) is a key ATO reporting requirement for many businesses that make payments to contractors or subcontractors. The industries that must file a TPAR through the Taxable Payments Reporting System (TPRS) have been added to the government’s list. Currently that list includes building and construction, government grant providers, IT services, and security services.

Is your current business structure (sole trader, partnership, or company) still the best option for you? Take into consideration liability protection, expansion objectives, and tax consequences when determining your business structure. Seek advice from an expert in taxes about how to organise your company to minimise taxes may be advantageous.

Consider combining the preparation of your EOFY and Research and Development Tax Incentive (R&DTI) documents for ultimate efficiency.

While you are already deep in reviewing financial records, assessing project costs, and finalising accounts as part of EOFY activities, why not consider including the preparation for your Research and Development Tax Incentive (R&DTI) claim?

Rather than seeing your R&DTI claim as a separate, later task, consider integrating it with your EOFY processes. Much of the detailed financial data required for R&DTI claims like payroll costs for R&D staff, specific project expenditures, and overhead allocation is already being gathered for your tax return and financial statements. By identifying and collating R&D specific information at the same time, you can significantly streamline workflows, reduce duplication of effort, and save valuable time and transform compliance from two separate burdens into one more efficient process.

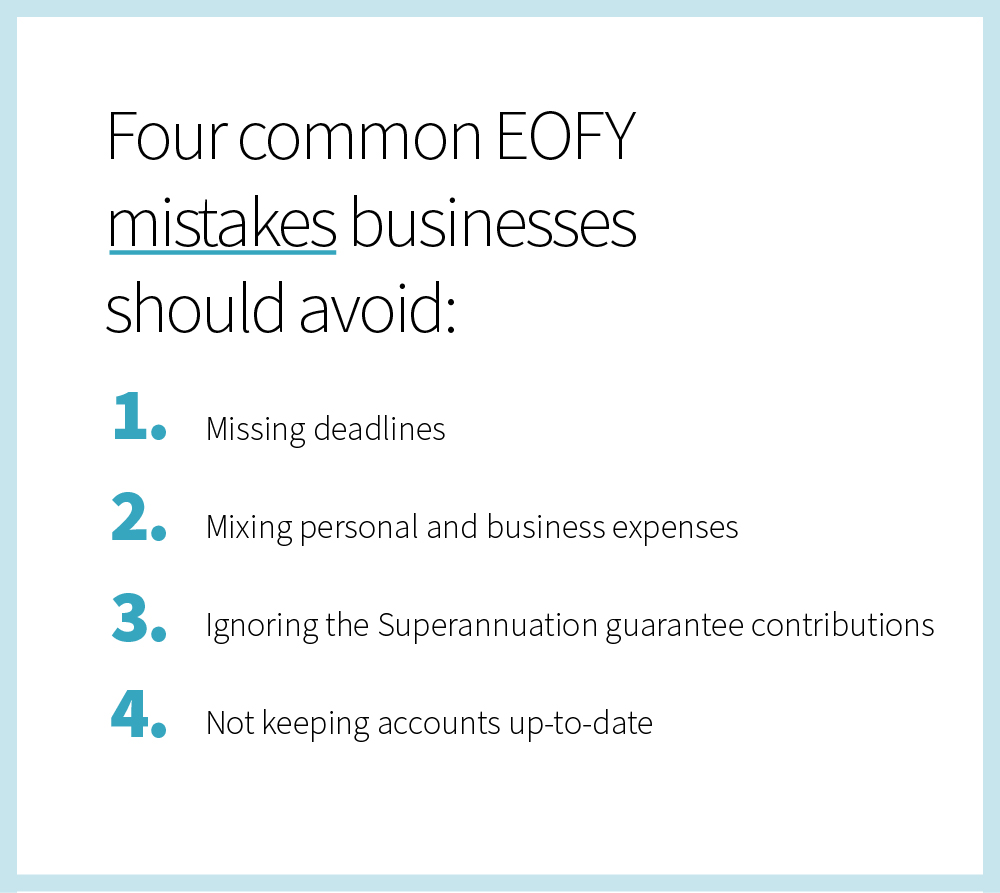

Here are the four most common mistakes you should avoid when it comes to EOFY.

EOFY isn’t just about closing the books; it’s the launchpad for smarter planning and accessing vital funding through grants and the R&D Tax Incentive. Strong EOFY records are essential for this, and although FundFindrs aren’t tax agents, we specialise in helping you leverage that financial data for successful funding applications. Connect with FundFindrs today to discuss maximising grants and R&DTI opportunities for your business. Book a FREE consultation today.