Why you should apply for the R&D Tax Incentive

Discover the program benefits and check your eligibility

The R&DTI is a non-competitive program offering up to 43.5% in tax offsets for eligible R&D activities. Last year, over 12,900 companies accessed $16.2 billion in funding, with the average claim valued at $403K.

-

Financial relief

Recover some of the costs associated with your R&D activities and boost cash flow.

-

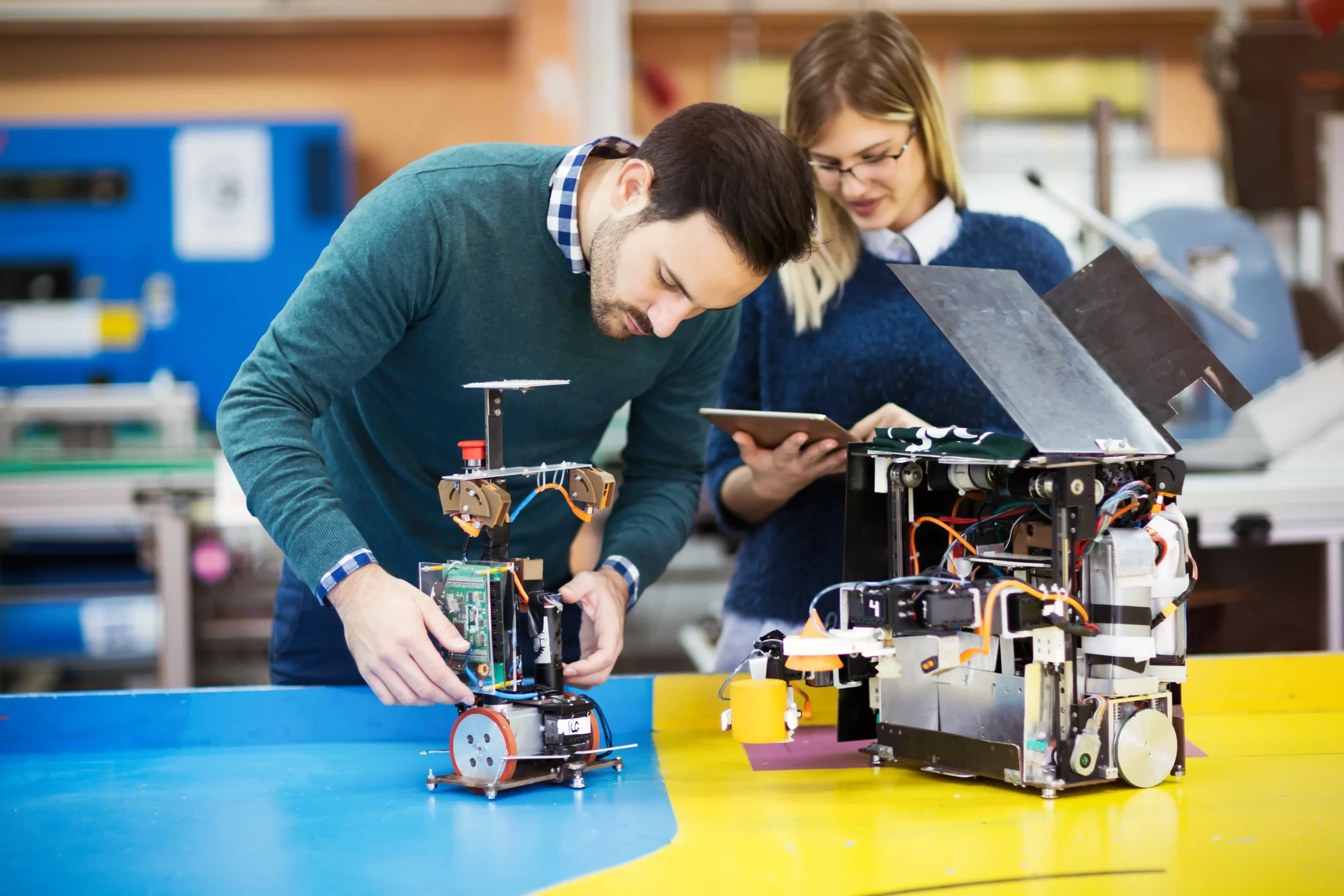

Encourages innovation

Develop new products, services, and processes through innovative projects.

-

Boosts competitiveness

Reinvest in your business and stay competitive in both domestic and international markets.

Download our R&DTI Blueprint